Covered Call Writer

Covered Call

A covered call is a two part transaction where you buy stock and then short a call option against that stock. Because 1 option controls 100 shares of stock, you would typically purchase 100 shares of stock and then sell 1 call option against that stock to create a covered call.

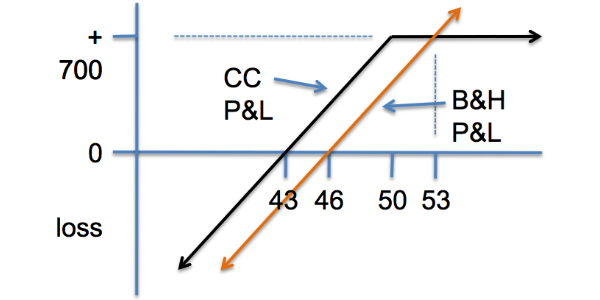

For example, on the right there is a graph of an investor who has purchased 100 shares of stock at $46/share (his break even is $46/share). He then sells 1 call option with a strike price of 50 for $3/share. This lowers his break even to $43/share while at the same time puts a cap on his upside -- the best he can do is have the stock called away at 50, which will net him a total of $53/share ($50 for the stock plus the $3 he received for the option).

The covered call profit & loss at expiration is shown in black, compared the buy-and-hold profit & loss shown in orange. At every price $53 or lower the covered call investor comes out ahead of the buy-and-hold investor.