Covered Call Writer

Call Option

A call option is a tradable security that gives the purchaser the right, but not the obligation, to buy 100 shares of stock on or before a certain date (the expiration date) at a certain price (the strike price).

Call option buyers are making short-term directional bets on a stock. If an investor thought that a stock would rise quickly in the short term, he could buy a call option to execute on his belief.

Buying call options is popular because of limited risk and unlimited upside. You can only lose the amount you pay for the option, even if the underlying stock drops to zero.

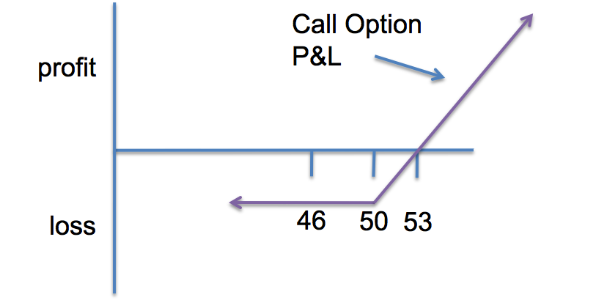

For example, on the right is the profit and loss graph for an investor who has purchased a 50-strike call option on a $46 stock. He has paid $3 for the option. The worst he can do is lose $3/share, no matter how low the stock goes.

At every price above the strike price of 50, the option will have some value on expiration day. His break even is $53/share. Anything above $53 on expiration day and he will have a profit. The catch is that there is a time limit; once the option expires no additional stock gain will benefit the option holder.